[ad_1]

We inform folks on a regular basis that retirement isn’t an age—it’s a monetary quantity. And it’s true! With cautious planning and constant investing, you possibly can retire by yourself phrases effectively earlier than you’re “supposed” to retire.

However Social Safety didn’t get the memo, apparently. They’ve one thing referred to as a full retirement age (FRA), which is used to determine when of us can obtain their full Social Safety advantages.

Hopefully you’ll be dwelling your dream retirement by then, however let’s speak about full retirement age and what it’d imply for your retirement future.

Table of Contents

What Is Full Retirement Age?

Full retirement age, typically often called regular retirement age, is the age when you can begin receiving your full Social Safety retirement advantages.1 However not everybody has the identical FRA.

What Is My Social Safety Full Retirement Age?

Your full retirement age depends upon what 12 months you had been born. For anybody born from 1943 to 1954, your FRA is age 66. After that, the complete retirement age will increase little by little for people born from 1955 to 1960 till it reaches age 67. When you had been born in 1960 or later, you develop into eligible for full Social Security retirement benefits when you hit age 67.2

Market chaos, inflation, your future—work with a pro to navigate this stuff.

That’s the place issues stand right now, however there have been discussions about elevating the complete retirement age in some unspecified time in the future to maintain Social Safety’s retirement belief fund from getting tapped out.3 It’s all simply speak at this level, however it is one thing to control.

|

Social Safety Retirement Age Chart |

|

|

Yr of Start |

Full Retirement Age |

|

1943–1954 |

66 |

|

1955 |

66 and a couple of months |

|

1956 |

66 and 4 months |

|

1957 |

66 and 6 months |

|

1958 |

66 and eight months |

|

1959 |

66 and 10 months |

|

1960 and later |

67 |

How Is My Full Retirement Age Profit Calculated?

Your FRA profit is calculated based mostly on how a lot cash you’ve made throughout your working profession. The Social Safety Administration (SSA) makes use of a math method and one thing they name bend factors to determine how a lot your profit checks must be.

Don’t fear, we’ll stroll you thru all of it good and sluggish. So, seize a pencil and a sheet of paper—it’s time to do some math!

Common Listed Month-to-month Earnings (AIME)

The very first thing the SSA will do is work out your common listed month-to-month earnings (AIME). In plain English, that’s your common month-to-month pay over the past 35 years.4

They’ll discover that quantity by including up your annual revenue out of your high 35 incomes years after which dividing that quantity by 420 (that’s the variety of months in 35 years).

So, let’s say your common wage out of your high 35 incomes years is $50,000. On this case, your AIME is (drum roll, please) . . . $4,167. However we’re not stopping there.

Bend Factors

Subsequent, we now have to run that AIME quantity by these bend factors we had been speaking about earlier. The mathematics nerds at SSA use this equation to determine your precise full retirement age advantages. Bend factors work similar to tax brackets, besides they’re designed to provide you cash as a substitute of taking cash away . . . so, that’s good!

Right here’s the way it works: The much less cash you’ve made all through your profession, the upper proportion of your wage you’ll get again from Social Safety in retirement. That approach, SSA advantages exchange a much bigger chunk of lower-wage staff’ revenue in retirement.

For these of you who begin getting advantages in 2022, you possibly can work out your full retirement profit with this method:5

90% of the primary $1,024 of your AIME

+

32% of your AIME between $1,024 and $6,172

+

15% of your AIME over $6,172

=

Your Full Retirement Age Profit

Now that we’ve received the equation laid out, let’s run that common month-to-month pay we used earlier by these bend factors. First, you’ll maintain 90% of the primary $1,024 ($922)—then 32% of every thing you made between $1,024 and $6,172 ($1,005). Since your AIME is under $6,172, we don’t have to fret about that third bend level.

So, in case you wait till your full retirement age to say your retirement advantages, you possibly can anticipate month-to-month Social Safety checks in retirement price $1,927 . . . rather less than half of the cash you’ll’ve earned every month throughout your profession.

Do I Must Wait Till Full Retirement Age to Begin Taking Advantages?

Right here’s some excellent news: You don’t have to attend till you attain your FRA to start out getting cash from Social Safety.

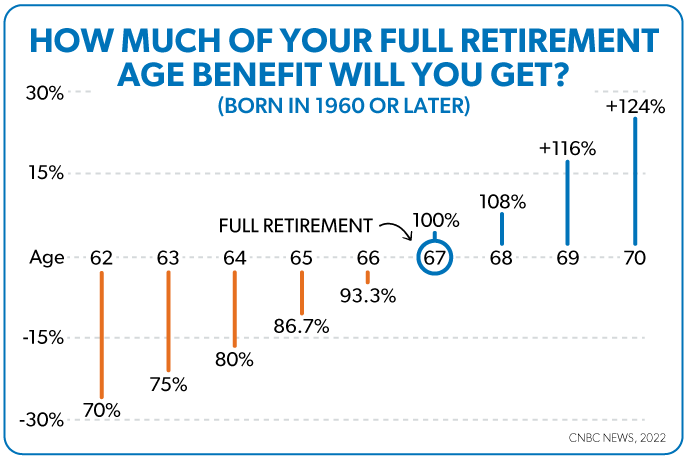

Along with ready till full retirement age, you have got two different choices: Take retirement advantages early beginning at age 62, or delay taking advantages up till your seventieth birthday.6

Each have their professionals and cons, so let’s take a better take a look at early and delayed retirement age advantages.

Early Retirement Age

You can begin taking Social Safety advantages as early as age 62 (any time between age 62 and your full retirement age is taken into account early retirement age).

However there’s a catch: The earlier you are taking retirement advantages, the much less cash you’ll get from Social Safety every month—and when you resolve to start out taking month-to-month funds, you’re caught with these funds. No take backs!

For instance, in case you had been born in 1960 or later and also you begin taking retirement advantages at age 62, you’ll obtain 70% of your full retirement age month-to-month profit (in case you had been born earlier than 1960, these percentages are a bit totally different).7 However on the plus aspect, you possibly can put that cash to make use of instantly, and also you don’t have to attend five-ish years to start out getting Social Safety checks.

Delayed Retirement Age

When you don’t want the cash instantly, you possibly can maintain off on taking advantages till after you attain full retirement age and obtain a bigger month-to-month profit. Something past your full retirement age is taken into account delayed retirement age, and your profit will increase till your seventieth birthday.

When you wait till age 70 to start out receiving retirement advantages, then you definately’d get month-to-month funds which are bigger than your full retirement profit (124% of your FRA profit in case you had been born in 1960 or later, to be actual).8

Utilizing our instance above, let’s say you resolve to take early retirement advantages at age 62. Meaning your month-to-month advantages cost could be $1,349. However what in case you waited till age 70? Then, Social Safety would ship you month-to-month checks price $2,389.

So, When Is the Greatest Time to Begin Taking Social Safety Advantages?

All this raises the query: Must you wait till full retirement age—or later—to start out taking Social Security benefits? Or does it make extra sense to take the advantages as quickly as you possibly can?

Monetary skilled Dave Ramsey says it is sensible (most often) to take the cash early and sometimes. Social Safety funds die while you die, so that you would possibly as effectively get all you may get as quick as you may get it. And in case you don’t want that Social Safety cash, you possibly can all the time make investments it in good growth stock mutual funds and simply let it develop. That approach, the cash at the least turns into a part of your property. When you take nothing, you get nothing!

However on the finish of the day, these Social Safety advantages shouldn’t actually matter all that a lot. Bear in mind, Social Safety is designed to exchange some of your revenue in retirement—not all of it.

When you invest 15% of your income in tax-advantaged retirement accounts throughout your working profession, you’ll have a lot cash in your nest egg that Social Safety will merely be the icing on the cake . . . a cake fabricated from all the cash you’ve invested in retirement accounts, like your 401(ok) and IRAs!

What Is the Common Retirement Age?

Do most individuals wait till they attain full retirement age to name it quits? Whereas ready till then means a bigger retirement profit verify, most individuals don’t wait that lengthy to retire. In truth, the average retirement age for present retirees is 62. In the meantime, folks nonetheless within the workforce anticipate to work a bit longer—they assume they’ll retire at age 64.9

Most folk additionally begin taking Social Safety advantages at age 62—whether or not it’s as a result of they deliberate to retire early or they had been pressured to due to their well being.10

Can I Accumulate Social Safety Advantages and Hold Working?

When you hit full retirement age, you possibly can proceed to work and earn as a lot as you need and nonetheless obtain your full retirement advantages on the identical time.

What in case you begin receiving advantages earlier than full retirement age and maintain working? Then it’s probably at the least a few of your retirement profit might be withheld. Womp womp. However it’s not all dangerous: Social Safety will ship you a better month-to-month profit when you attain full retirement age to make up for it.11

Work With an Funding Professional

With a continuing darkish cloud of uncertainty round whether Social Security will keep providing full benefits within the years to return, it’s extra necessary than ever to take cost of your retirement future.

That’s why you want an funding skilled in your nook. When you have questions on Social Safety advantages or need assistance organising a plan for retirement, you possibly can attain out to an funding skilled by the SmartVestor program. Your retirement future is simply too necessary to go away within the palms of a bunch of bureaucrats in Washington!

Able to get began? Find your investment pro today.

[ad_2]

Source link