[ad_1]

Daydreaming about retirement may be simple—you get to do what yoc need, everytime you need, whether or not it means touring the world over or selecting up a brand new interest. However on the identical time, the considered retirement may be daunting, particularly with regards to determining the way you’re going to help your self financially.

Many employees ask themselves, “how a lot do I must retire?” There isn’t a clear-cut reply, because the sum of money you’ll want to save for retirement will depend on quite a lot of elements, corresponding to your revenue and the kind of way of life you wish to dwell throughout your golden years. With a view to have a considerable nest egg to help you all through retirement, you’ll wish to think about making ready, saving, and investing as early as doable.

That can assist you get a leap begin on retirement planning, we’ve created this information on how a lot you’ll want to save for retirement and alternative ways you’ll be able to start planning for retirement.

On this retirement sequence, we’ll be offering you with an summary of the important features of retirement planning, like how a lot you’ll want to save from your paycheck to arrange for retirement, the perfect ways to start saving for retirement, some 401(k) basics, and different vital info.

On this chapter, we’ll be answering vital questions like “how a lot cash do I must retire?” and “how do I save for retirement?” Proceed studying or use the hyperlinks under to get began.

Table of Contents

Calculate How A lot You Want for Retirement

So how a lot do you’ll want to retire?

There is no such thing as a clear minimize reply to this query, as figuring out how a lot cash you’ll want to save for retirement relies upon largely in your revenue, how you intend to dwell throughout retirement, and what you count on your living expenses to be. So, the quantity you want for retirement can differ from individual to individual. When you plan on touring extensively or have costly medical points, the sum of money you want for retirement is perhaps greater than somebody with inexpensive plans.

In line with a current survey by Charles Schwab, it was discovered that contributors consider they want about $1.7 million saved to retire. On prime of this, the Federal Reserve discovered that 37 % of non-retired adults consider their retirement financial savings are on observe, whereas 44 % consider they’re not on observe, and the remainder are uncertain. This could make saving up for $1.7 million seem to be an unattainable purpose.

Don’t let these stats deter you. There are a lot of methods you’ll be able to take motion and get your retirement financial savings on observe. As you start saving for retirement, be aware of how much you should have saved by your age.

Whereas monetary specialists can’t agree on a set sum of money you must have saved for retirement, these estimates can function a guiding reference level.

No matter formulation you utilize, it’s vital to do not forget that the retirement financial savings you want by age differ on a case by case foundation.

Use our free retirement calculator to determine how far more you’ll want to save for retirement.

Elements to Take into account As You Put together

There are quite a few elements that may alter how a lot you’re in a position to save for retirement all through your life, corresponding to balancing saving for retirement and your kid’s college, mortgage funds, student loan debt, medical bills, credit card debt, and so forth. A big quantity of financial planning has to enter determining an correct retirement budget, however we’re right here to give you some useful ideas for how one can get began.

The important thing to reaching any form of retirement purpose is to start saving as early as you’ll be able to. You may as well comply with the pay your self first technique, which states that people ought to instantly save a portion of their paycheck earlier than spending it on something. This mindset will help put more cash in direction of your monetary objectives, like retirement.

Your savings rate, which is the sum of money you save every month in comparison with your gross revenue, is likely one of the most vital percentages to account for with regards to assessing your retirement financial savings. And thankfully, there are fairly a couple of methods you’ll be able to go about saving for retirement.

Check out alternative ways to save lots of for retirement within the part under.

How Do I Save for Retirement?

So we’ve answered “how a lot cash do you’ll want to retire?”, however what about “how do you save for retirement?” We’ll reply that within the part under.

Whether or not you’re simply coming into the job market or are nearing retirement, there are quite a few financial savings autos and plans you can make the most of to succeed in your retirement purpose.

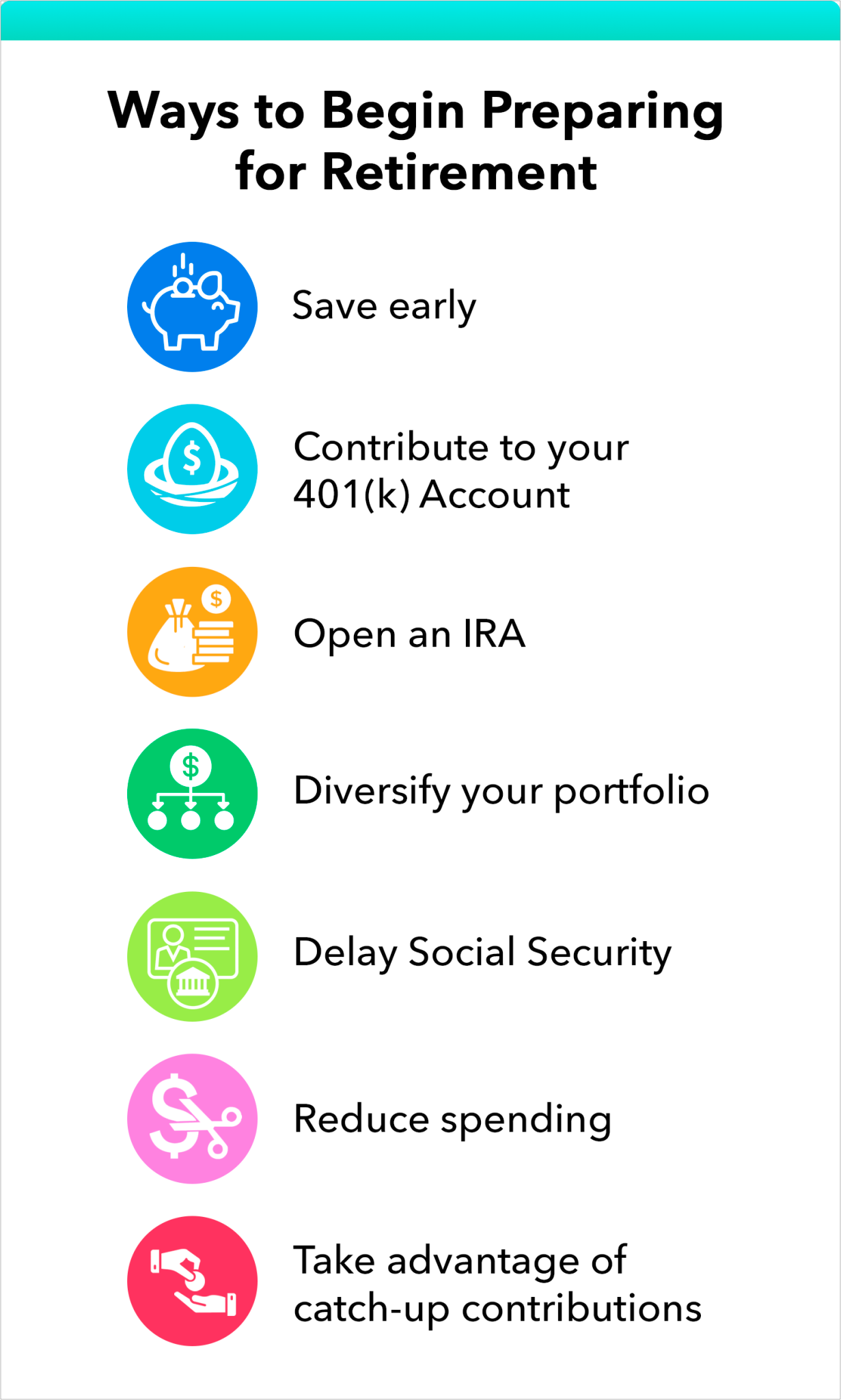

Save Early

Compound curiosity is a robust factor. The sooner you start saving cash, the extra you’ll be able to have sooner or later, because of compound curiosity. Compound interest is the method of your principal incomes curiosity after which persevering with to earn curiosity on the curiosity it has earned previously. Although that is based mostly on the cash staying in an account or being reinvested additional time which implies if you happen to pull cash or the curiosity out you cut back the facility of this course of.

For instance, let’s say you place an preliminary funding of $10,000 right into a high-yield financial savings account that has an annual share yield of seven.00 %, and it compounded month-to-month. With out contributing any cash after your preliminary funding, you’ll have about $187,549 in 42 years once you attain 67 years previous. Now, let’s say your greatest buddy began with the identical preliminary funding, however ten years later, on the age of 35. By the point they attain 67 years previous, they’d solely have about $93,323.

As you’ll be able to see, saving early can earn you more cash down the road. Some widespread compound curiosity investments embody:

There are a number of totally different locations you’ll be able to make investments your cash, however there are additionally sure investments that you should consider prioritizing over others, like a 401(ok), an IRA, or a well being financial savings account. You’ll earn extra curiosity with all these accounts and make more cash you can put in direction of retirement.

401(k)s and IRAs are additionally examples of tax-deferred financial savings, which is basically an funding account that lets you postpone paying taxes on the cash till it’s withdrawn after retirement. Much less taxes it’s a must to pay means more cash in your pocket.

Contribute to Your 401(ok) Account

Traditional 401(k) accounts will let you contribute pre-tax {dollars}, which lowers your taxable revenue now. Some employers may even supply an employer match as much as a sure %, which is just about like free cash. This implies if you happen to put apart 5 % of your revenue, for instance, to your 401(ok), and your employer presents a one hundred pc match on the primary 5 %, it’ll be as if you happen to’re contributing 10 % of your revenue to your 401(k).

Nevertheless, there are 401(k) contribution limits, which generally improve every year. Contribution limits may differ by:

- Age

- Retirement plan

- If a person is taken into account extremely compensated

It’s vital to pay attention to the typical 401(ok) steadiness by age so you’ll be able to work out precisely how a lot you’ll be able to contribute to your plan.

401(k) retirement plans additionally compound curiosity and returns, which implies your cash will be capable of develop sooner over time, if all of the revenue is reinvested and saved within the account. When you occur to depart your employer, you may have loads of choices with regards to your 401(ok). You may go away it as is, roll your 401(k) into an IRA, or roll it into your new employer’s 401(ok) if they provide one. There are professionals and cons for every of those choices, so do your analysis earlier than making a choice.

Making an early 401(ok) withdrawal is perhaps tempting to do in an effort to cowl sudden bills, however it may possibly do extra hurt than good. Once you make an early 401(k) withdrawal:

- Your taxes are withheld

- You will get penalized by the IRS

- You may lose 1000’s of {dollars} in progress

Attempt to keep away from withdrawing out of your 401(ok) early as it could jeopardize your future monetary stability.

Open an IRA

In case your employer doesn’t supply a 401(ok), or if you wish to have a number of retirement accounts to contribute to, an individual retirement account (IRA) could be a sensible concept. IRAs present many tax benefits for retirement financial savings, much like 401(ok) accounts. There are two popular IRAs you’ll be able to make the most of:

- Conventional IRAs will let you make tax-deductible contributions. Once you withdraw in retirement, your withdrawals can be taxed as revenue.

- Roth IRAs will let you contribute after-tax funds and are usually not tax-deductible. Once you make withdrawals in retirement, they’ll be tax-free.

Each varieties of IRAs may be nice choices for retirement financial savings. The one you select relies upon by yourself preferences and monetary state of affairs.

Diversify Your Portfolio

As they are saying, don’t put all your eggs in a single basket. This saying is related with regards to saving for retirement. Diversifying your portfolio may be a good way to develop your nest egg. Having funds in varied securities can cut back threat within the occasion of a bear market or any market corrections. Some ways you can begin investing and unfold your wealth embody investing in:

You don’t want to put your cash in dozens of various autos. Beginning off with just some will help you retain observe of every funding and handle your portfolio simpler.

Needless to say there are additionally sure investing errors that you just want to avoid, like investing too aggressively or too conservatively, and never diversifying your portfolio sufficient.

Delay Social Safety

The Social Safety Administration (SSA) was created after the Nice Despair left hundreds of thousands of Individuals with no financial savings. This program was particularly designed for these most susceptible: the aged, disabled people, and their survivors. At the moment, Social Safety serves the identical goal and offers Social Security benefits to:

- Retired employees

- Disabled employees

- Their survivors, corresponding to dependent youngsters and spouses

Eligible retirees are in a position to withdraw Social Safety funds as early as 62 years-old. There’s a catch, although. When you withdraw payments before your full retirement age (FRA), your advantages can be decreased a fraction of a % for every month for everything of the funds.

Delaying Social Safety, alternatively, has reverse results. When you delay your Social Security benefits, you’ll be able to improve the quantity of the advantages you obtain sooner or later.

For instance, in case your full retirement age is 66 years-old, your 12-month price of improve is 8 %. Meaning, when you attain 67 years-old, you’ll obtain 108 % of your month-to-month profit. This improve stops when you attain the age of 70, that means you’ll obtain 132 % of your month-to-month profit by the point you attain this age. As you’ll be able to see, delaying Social Safety for even a couple of years could make an enormous distinction in the long term.

Social Safety could be a nice type of supplemental revenue throughout retirement. Nevertheless, Social Safety advantages sometimes solely cowl about 40 percent of your pre-retirement income, which is why planning and saving early ought to be taken significantly. Moreover, Social Safety shouldn’t be assured. At the moment, the Social Security Board of Trustees projects program cost to rise by 2035; at that time, taxes can be sufficient to pay for under 75 % of scheduled advantages. So present profit estimates are probably over estimated.

Cut back Spending

Budgeting is one other vital issue with regards to planning for retirement. Making a plan to scale back spending will help you place more cash into totally different retirement autos, corresponding to an IRA or financial savings account.

In relation to reducing spending, think about bills you could now not want, corresponding to:

- Streaming service subscriptions

- Going out to dinner

- Costly fitness center memberships

Mint presents a free budget calculator that you should utilize to trace your spending and make a plan for the longer term.

Take Benefit of Catch-up Contributions

There are limits to how much you can contribute to your 401(k) and IRA plans. Nevertheless, once you attain the age of fifty, you’re entitled to catch-up contributions.

- For 401(ok) plans, you’re eligible to contribute an extra $6,500 on prime of the $20,500 contribution restrict in 2022.

- For IRA plans, you’re eligible to contribute an extra $1,000 on prime of the $6,000 contribution restrict in 2022..

When you haven’t been in a position to contribute as a lot as you’d like over time, catch-up contributions will help you get again on observe.

The 4 P.c Rule

So, what do you have to do together with your cash when you attain retirement? Withdrawing all of your hard-earned financial savings and occurring an extravagant journey could sound like a good suggestion, however finance specialists produce other recommendation: the 4 % rule.

The 4 % rule got here from a 1998 examine referred to as the Trinity Study and is pretty easy. It says, throughout retirement, retirees ought to solely withdraw 4 % from their retirement portfolios to not run out of cash over a 30-year interval. So, you must withdraw $4,000 for each $100,000 you may have saved. The 4 % rule may be a good way to dwell comfortably throughout retirement with out compromising all your financial savings.

Though that is acknowledged as a rule, it’s greatest to have a look at it as a suggestion. Each retiree is totally different, with their very own:

- Tax bracket

- Sources of revenue

- Investments

- Monetary plan

And all of those ought to be thought-about when making monetary selections, whether or not or not it’s utilizing a credit card or investing in a number of securities to fund their golden years. Take this with a grain of salt, and think about consulting with a financial advisor with regards to making monetary selections throughout retirement.

Remaining Concerns When Deciding How A lot to Save

There are a couple of key issues you must bear in mind when finalizing your retirement plan, corresponding to:

- The place you wish to dwell: The place you wish to dwell will closely impression how a lot your financial savings have to be. Retiring in Ohio goes to be loads cheaper than retiring in California. However you don’t should retire someplace that’s going to fully wipe out your financial savings, actually there are numerous affordable places to retire, the place you’ll be able to dwell lavishly whereas saving cash.

- What sort of way of life you wish to lead: Do you wish to go on extravagant journeys each month and splurge on designer items? Or do you envision spending your golden years enjoyable at residence together with your partner? The kind of way of life you intend to steer closely impacts your financial savings objectives.

- Whether or not you intend to personal a house or lease: Proudly owning a house presents extra stability, tax advantages, and fairness, however renting a house offers extra flexibility and fairness, and also you’ll most likely find yourself spending much less cash on upkeep.

- Whether or not you wish to downsize: Downsizing your house throughout retirement can have some benefits, but it surely’s not for everybody. Since housing could be a main expense, it’s positively one thing you wish to think about when planning for retirement.

Key Takeaways: How A lot Do I Have to Retire?

- Figuring out how a lot cash you’ll want to save for retirement relies upon largely in your revenue and the way you intend to dwell throughout retirement.

- In line with a current survey by Charles Schwab, it was discovered that contributors consider they want about $1.7 million saved to retire.

- The important thing to reaching any form of retirement purpose is to start saving as early as you’ll be able to.

- There are quite a few financial savings autos and plans you can make the most of to succeed in your retirement purpose, like:

- Saving early

- Contributing to your 401(ok) plan

- Opening an IRA

- Delaying your Social Safety

- Lowering spending

- Finance specialists suggest following the 4 % rule when you enter into retirement, which is that retirees ought to solely withdraw 4 % from their retirement portfolios to not run out of cash over a 30-year interval.

Wrapping Up

How a lot you want for retirement will depend on quite a lot of elements. Some retirees could have further sources of revenue, corresponding to from part-time jobs, Social Safety, and pensions that decide their quantity wanted to retire. Or, some may decide to retire early or have plans for an extravagant way of life throughout their post-career years.

No matter your state of affairs is, it’s vital to start planning early to dwell comfortably in retirement. There are quite a few retirement autos obtainable, corresponding to IRAs, 401(ok) plans, investments, and extra. At Mint, we will help you get began together with your retirement plan with our free online budget calculator.

Now that you’ve the wheels turning about how a lot cash it takes to retire comfortably, you’ll be able to transfer on to the subsequent chapter within the sequence, which covers how a lot to save lots of every month for retirement.

That is for informational functions solely and shouldn’t be construed as authorized, funding, credit score restore, debt administration, or tax recommendation. You must search the help of an expert for tax and funding recommendation.

Third-party hyperlinks are supplied as a comfort and for informational functions solely. Intuit accepts no accountability for the accuracy, legality, or content material on these websites.es.

Use these assets to get your funds on observe:

Free monetary calculators to make use of.

Suggestions to enhance your funds.

Free funds calculator to attempt.

Steps to monetary wellness.

[ad_2]

Source link