[ad_1]

Golden years require some gold.

Are you saving for retirement? You ought to be, even when your golden years are greater than half your lifetime away. The earlier you start, the much less you’ll want to avoid wasting every month.

Too many individuals do not know how a lot they’ll must stay comfortably by means of retirement. In line with the 20th Annual Transamerica Retirement Survey, solely 27 % of employees have a written monetary technique for retirement.

It’s by no means too late to begin saving, and it’s additionally by no means too early. However you’ll want a funds to point out how far you’ve come and the place you’re headed. Studying easy methods to begin saving for retirement is essential for everybody. There are many methods you may save for retirement—401(ok) accounts, IRA accounts, financial savings accounts, and so forth.

In Chapter 3 of our retirement sequence, we’ll go over easy methods to save for retirement, one of the best ways to avoid wasting for retirement, when to begin saving for retirement, and extra. You should use the checklist under to leap to a bit you’re interested in, or you may learn by means of for a extra thorough understanding of saving for retirement. Have a look!

Within the earlier chapters we mentioned how much you need to avoid wasting for retirement, and the way a lot you could save from each paycheck. To brush up on these subjects, return and browse these chapters. In any other case, preserve studying to find out about easy methods to make a retirement budget that works for you.

Table of Contents

Step One: Calculate How A lot Retirement Financial savings You’ll Want

Your living expenses won’t be the identical at retirement. Perhaps your private home will probably be paid off by then, however the price of residing will definitely be greater. If you wish to journey, you’ll want extra financial savings. Calculating retirement funds takes a whole lot of consideration. The most secure strategy is to err on the beneficiant facet since having greater than you want can by no means be a nasty factor.

In terms of making a budget for retirement, it’s a good suggestion to begin by differentiating your desires and desires. Certain, a Masserati and beachfront property appears like an effective way to get pleasure from your sundown years, however will you find the money for to pay for utilities, property taxes, and meals? To determine how a lot retirement financial savings you’ll want, you could take into consideration where you’ll retire and what your way of life will probably be.

The Department of Labor estimates that you just want roughly 70 to 90 % of your pre retirement revenue to stay comfortably in retirement. Budgeting for retirement may help you determine how much money you need to have saved with a purpose to stay comfortably and possibly even splurge on one thing new, like a trip to Europe or a pontoon boat for the lake.

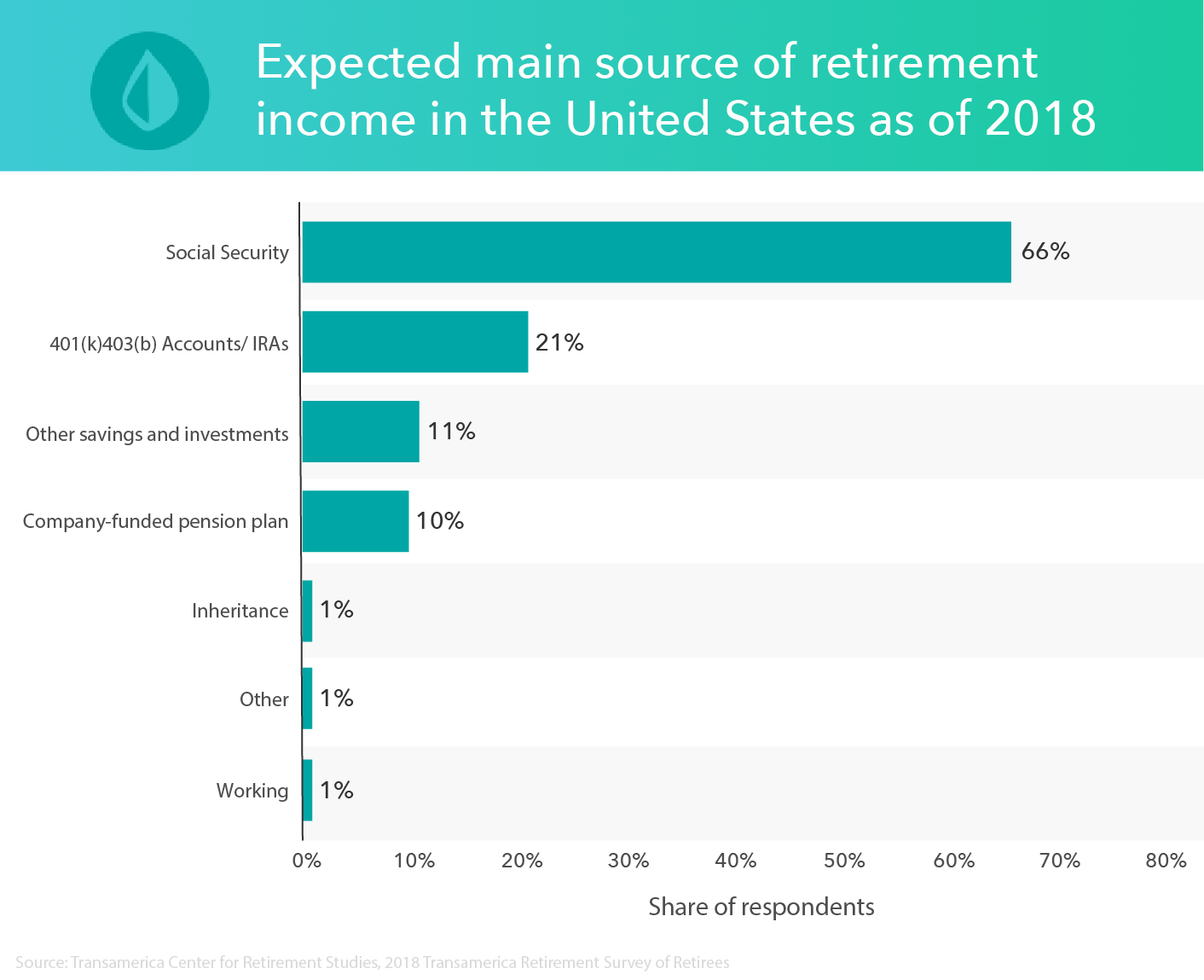

Start your retirement fund by figuring out your retirement financial savings objectives. Retirement savings calculators, such because the free one from Mint, do many of the give you the results you want. It consists of fields to incorporate the quantity you might be scheduled to receive in Social Security benefits and investments. Fill within the blanks, and the calculator reveals their estimated quantity that you just’ll must have in your retirement financial savings. Monetary calculators may also assist you determine how a lot you could funds with a purpose to attain your monetary objectives, like retirement.

Different methods to find out your retirement financial savings objectives embrace:

- Consulting with a monetary advisor

- Filling out a budgeting worksheet

- Enlisting the assistance of a web-based budgeting device, just like the Mint app.

However no matter what you do, it’s crucial to make a financial plan that outlines your retirement objectives and the way you’re going to obtain them.

It’s also possible to check out the pay yourself first technique, which is a financial savings technique the place you set a portion of each paycheck earlier than you set extra in direction of any bills. This technique may help you prioritize saving on your monetary objectives, like retirement.

Totally different Retirement Accounts

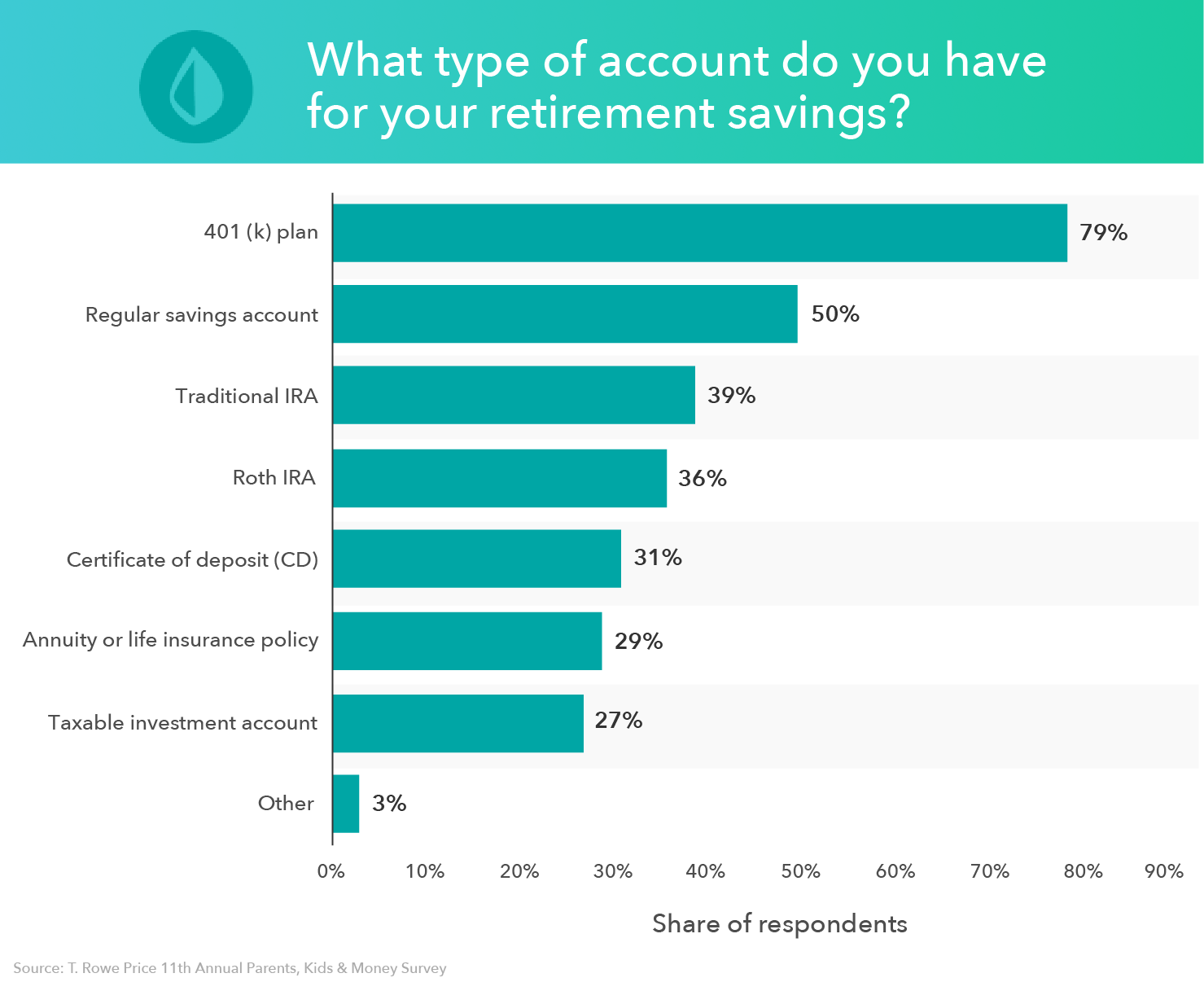

As you calculate how a lot retirement financial savings you’ll want, it’s important to know your choices on the place to avoid wasting your cash.

Many retirement accounts place limits on how a lot it can save you up every year, however there are just a few totally different retirement accounts the place you may contribute extra of your wage yearly.

- 401(ok): A 401(ok) is a retirement account that’s arrange by an employer that permits employees to contribute a portion of their wages to the account. Earnings made by means of a 401(ok) account aren’t taxed till they’re withdrawn in retirement. Some employers additionally provide a 401(ok) match, the place they may match all, or a portion of your contributions. You may be taught more about 401(k) accounts on Mint.

To get the most out of your 401(k) plan, make investments as much as the match and purpose to succeed in the contribution restrict—so long as you are able to do so comfortably. The annual contribution limit in 2022 is $20,500.. In the event you’re 50 years or older, you’re granted a catch-up contribution of $6,000, that means you may contribute $25,000 to your 401(ok). Your purpose must be to fulfill the typical 401(k) balance by age so you may ensure you’re on observe along with your financial savings. You also needs to keep away from 401(ok) early withdrawal, even when you’ve got debt to pay, as it might probably trigger you to lose hundreds of {dollars} in potential progress.

- Conventional IRA: A traditional IRA is a retirement account that means that you can make a contribution that will probably be deducted out of your taxes throughout that 12 months. When you withdraw cash out of your conventional IRA throughout retirement, you’ll have to pay revenue taxes.

Every year, you may contribute up to $6,000 to your Conventional IRA, and $7,000 in case you’re 50 years previous or older. To get probably the most out of your retirement financial savings, purpose to succeed in the contribution restrict.

- Roth IRA: A Roth IRA and Traditional IRA are very comparable. The primary distinction is that with a Roth IRA, your contributions aren’t deductible through the tax 12 months you make the contribution. Nevertheless, which means while you withdraw funds out of your Roth IRA in retirement, they received’t be taxed.

As with a Conventional IRA, the contribution restrict for 2022 is $6,000 and $7,000 in case you’re aged 50 or older. Intention to contribute $6,000 to get probably the most out of your retirement.

Contributing a big % of your annual wage in direction of retirement financial savings might look like a frightening activity at first, however you might be nearer than you suppose.

In the event you contribute 5 % of your wage to your 401(ok) and your employer supplies a 5 % match, you’re already at 10 %. And in case you’ve reached the contribution restrict on your conventional or Roth IRA and nonetheless haven’t reached your purpose, you may return to your 401(ok) and contribute the remaining there, so long as you don’t exceed $20,500. When you’ve got an previous 401(ok) account, you too can get an IRA rollover and put these funds into an IRA account whereas sustaining the tax-deferred standing of your investments.

401(ok) accounts and IRAs are thought-about tax-deferred savings plans, which lets you postpone paying taxes on the cash in your account till you withdraw it, which usually received’t occur till retirement. A 401(ok) and IRA are each good investment accounts to economize for retirement.

However whether or not you spend money on a 401(ok) account or an IRA, It’s essential to understand your savings rate when making ready for retirement with the intention to save up more cash on a month-to-month foundation. The more cash you save in these accounts now, the extra you’ll have later, due to the benefits from compound interest.

How A lot Cash You Ought to Have Saved by Age

Probably the most urgent query many individuals have is when to begin saving for retirement. Keep in mind, as we beforehand mentioned, it’s by no means too late or too early to plan for retirement. One of the best ways to avoid wasting for retirement, nonetheless, is to start early. This implies you received’t need to contribute as a lot cash afterward in life.

For many individuals, their contributions regularly enhance as they age. Nevertheless, how a lot you’re in a position to put away every year possible will depend on the opposite monetary elements in your life on the time. Learn Chapter 9 to be taught extra about saving for retirement by age and decide whether or not you’re on observe.

Step Two: Create a Price range to Save for Retirement

Retirement calculators often produce an infinite greenback quantity. Changing 80 % of a modest yearly wage may require one million {dollars} in financial savings or rather more if there aren’t any different anticipated sources of revenue. That’s a whole lot of financial savings, however spreading it out over a few years means your month-to-month contribution received’t be as a lot.

A retirement calculator can help you with saving for retirement. To create a funds to avoid wasting for retirement, preserve these elements in thoughts:

- Fastened bills: These are recurring bills that don’t change. Examples of fastened bills embrace lease, month-to-month payments for providers like cable, gymnasium memberships, and cell telephones, together with insurance coverage and taxes. Figuring out the fastened bills you’ll have throughout retirement will help you calculate how a lot cash you’ll must get by.

- Leisure: Retirement is a time so that you can pursue your passions and hobbies. Whether or not it’s touring the world or choosing up golf, put aside an estimate for a way a lot cash you’ll want for enjoyable and hobbies.

- Medical prices: Sadly, with previous age comes an elevated likelihood of well being considerations. In the event you retire earlier than 65 while you’re eligible for Medicare, you’ll have to pay on your medical health insurance. Be sure you create an emergency fund for medical bills in case any well being considerations pop up.

After getting your entire bills tallied up, you’ll be capable of decide how a lot cash you’ll want for retirement.

Now’s the time to search out more money in your funds to dedicate to retirement, however generally there doesn’t appear to be something left after the payments are paid. That’s the place funds software program, akin to Mint.com, may help.

By opening an account and getting into your entire monetary info, Mint may help you discover cash and counsel methods to allocate it to financial savings. For instance, an outline of your bills and revenue may reveal an imbalance which you can appropriate.

Mint can expose spending patterns that you just weren’t conscious of, and present you ways they add up month-to-month. Mint may also make strategies in case you’re spending an excessive amount of in curiosity based mostly on one other lender or bank card that provides a decrease charge. Each penny you discover can flip into worthwhile retirement financial savings.

Now’s one of the best time to get on observe.

Step Three: Take into account Investments to Complement Retirement Financial savings

Because the previous saying goes, your cash ought to give you the results you want. Placing cash in a cookie jar leaves precisely the quantity saved. In an interest-bearing financial savings account, there could possibly be barely extra over time. In the event you actually need to watch your cash develop, take into consideration investing.

Investments at all times carry threat, however some are a lot riskier than others. If you find yourself younger, these chances are high simpler to take. There are nonetheless years forward to get better from inventory market drops and different losses. As you develop nearer to retirement, you may take into account switching to much less dangerous investments to maintain your cash safer. If you wish to begin investing, ensure you do thorough analysis about what sort of investments are finest for you.

Bills to Make Certain You Account for in Your Retirement Price range

There are a selection of prices that you could ensure you account for in your retirement funds above and past your typical residing bills, akin to:

- Taxes: You have to account for the potential for your property taxes growing in your retirement funds with the intention to find the money for saved up.

- Emergencies: This consists of situations like dwelling repairs, healthcare emergencies, and different surprising prices.

- Grandkids: You won’t suppose to incorporate your grandkids in your retirement funds, however between birthdays and holidays, in addition to spending high quality time, caring on your grandkids can get costly so it’s essential to incorporate these bills in your funds.

- Lengthy-term care: We’re residing longer than ever earlier than, which suggests there’s much more bills to account for. Whereas it is perhaps onerous to consider your life in your 80s and 90s, long-term care is unquestionably one thing to consider with regards to saving cash for retirement.

- Bucket-list objectives: When you’ve got an in depth checklist of stuff you need to accomplish in your golden years, you could account for these prices. And even in case you don’t, you might tackle an costly pastime, so that you’re higher off having cash saved up on your bucket-list objectives.

Retirement Price range Instance

For some extra readability about what a retirement funds may seem like, you may try the next retirement funds instance:

- Retirement revenue sources:

- Social safety revenue

- Firm pensions

- Rental revenue

- Funding revenue

- Annuity revenue

- Different retirement plans

- Housing bills:

- Mortgage or lease

- Actual property taxes

- Upkeep and restore

- House insurance coverage

- Residing bills:

- Meals and groceries

- Transportation

- Auto insurance coverage

- Leisure

- Insurance coverage

- Utilities

- Clothes

When you’ve calculated all of those prices, it’s a must to discover your discretionary revenue, which is your revenue that’s left over after you pay taxes and deal with your residing bills. You may calculate your discretionary revenue by subtracting taxes and your entire important month-to-month bills out of your whole revenue. Any leftover discretionary revenue can be utilized to pay for further expenditures and surprising prices.

Extra Suggestions for Saving Cash for Retirement

Contributing cash to employer-sponsored 401(ok) plans and IRAs aren’t the one choices you’ve for saving cash for retirement. Other than investing your cash, you can also make just a few way of life modifications to extend your nest egg. Dol.gov gives an excellent publication on planning for retirement with worksheets and data on budgeting for retirement and monitoring down bills.

Extra steps you may take to economize for retirement embrace:

- Monitoring your spending: With a budgeting app like Mint, you may observe your spending to see the place your cash goes. Keep away from spending cash on non-essential gadgets, akin to going out to a elaborate dinner each night time or subscribing to each streaming service provided on-line. You’ll be stunned how a lot it can save you by eliminating impulse buys and costly providers.

- Benefiting from your well being financial savings account (HSA): In case your employer gives a excessive deductible well being plan (HDHP) that comes with an HSA, you might take into account contributing as much as the contribution limit. Why? HSAs can cowl your present and future medical prices, and funds go straight from payroll to your account. HSA contributions are additionally pre-tax and tax-deductible, that means while you make a withdrawal for a certified expense, you received’t be taxed.

- Paying off your money owed: Being in debt can value you some huge cash. Not solely is the principal stability one thing to fret about, however the curiosity you accumulate will be dangerous, too. Paying off your money owed as quickly as attainable, akin to bank card debt, your mortgage, scholar loans, and auto loans will help you put more cash in direction of retirement fairly than compounding curiosity.

Key Takeaways on Saving for Retirement

- Many Individuals aren’t absolutely ready for retirement and don’t find the money for saved as much as stay comfortably after they retire.

- Probably the greatest methods to avoid wasting for retirement is by benefiting from the numerous financial savings accounts on the market, akin to 401(ok) accounts and IRA accounts.

- For conventional retirement accounts, your taxable revenue will probably be decreased based mostly on the quantity of your contributions, supplying you with a pleasant tax break. Roth accounts, however, will gather taxes in your contributions while you make them however will help you withdraw cash tax-free in retirement.

- Budgeting for retirement prematurely may help you keep on observe on your financial savings objectives.

- Investing in shares and diversifying your portfolio is an effective way to complement your retirement financial savings.

- Monitoring your spending, benefiting from your well being financial savings account, and paying off your money owed are extra methods it can save you for retirement.

Retirement is supposed to be loved. Studying how to economize for retirement may help you reside your retirement years to the fullest. One of the best ways to get probably the most out of your retirement financial savings is by planning forward and committing to these plans over the lengthy haul.

Mint gives funds merchandise that assist make budgeting and saving easy, so that you will be certain you’re at all times on high of the sport. Sign up for a free account at this time and see how Mint may help your retirement plans.

With a good suggestion in thoughts of easy methods to go about making a retirement funds, you’re ready to maneuver onto Chapter 4 of our retirement sequence, which covers one of the best methods to avoid wasting for retirement.

That is for informational functions solely and shouldn’t be construed as authorized, funding, credit score restore, debt administration, or tax recommendation. You must search the help of an expert for tax and funding recommendation.

Third-party hyperlinks are offered as a comfort and for informational functions solely. Intuit accepts no accountability for the accuracy, legality, or content material on these websites.

[ad_2]

Source link